The Weak Axiom of Revealed Preference (WARP): Graph Explanation

- Rahul Subuddhi

- Sep 24

- 9 min read

What is the Endowment Budget Constraint?

The endowment budget constraint arises in economic models where a consumer or agent begins with an initial allocation of goods, known as the endowment, and can trade these goods in a market to reach a preferred bundle. Unlike the standard budget constraint based solely on income and prices, the endowment budget constraint reflects the value of the initial endowment, which determines the feasible set of trades. The consumer can consume their endowment, sell part of it, or buy more goods, depending on market prices, but their total expenditure cannot exceed the value of their endowment at prevailing prices.

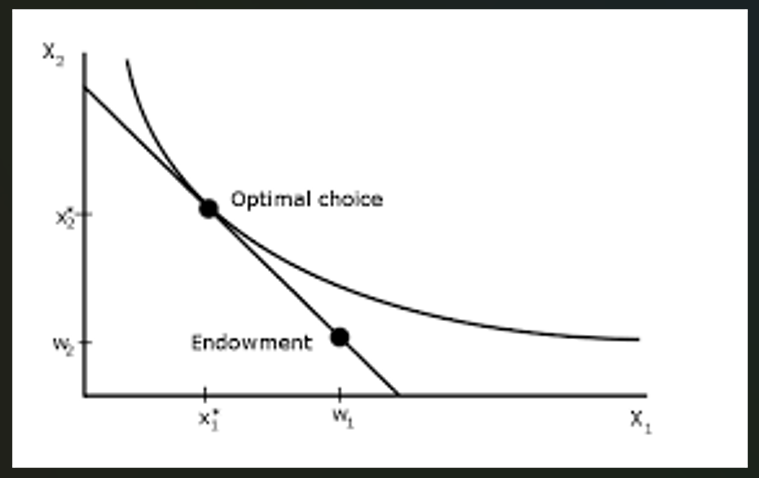

In the graph, the endowment point (w=(w1,w2) w = (w_1, w_2) w=(w1,w2)) represents the initial holdings of goods x1 x_1 x1 and x2 x_2 x2. The budget line passing through this point shows all possible combinations of x1 x_1 x1 and x2 x_2 x2 that the consumer can afford by trading their endowment, with the optimal choice (x∗ x^* x∗) indicating the preferred bundle after trade.

Graphical Representation of the Endowment Budget Constraint

The provided graph illustrates the endowment budget constraint with the following elements:

Axes and Goods:

The vertical axis represents x2 x_2 x2, and the horizontal axis represents x1 x_1 x1, showing the quantities of the two goods.

The endowment point w=(w1,w2) w = (w_1, w_2) w=(w1,w2) is marked, indicating the consumer’s initial allocation (e.g., w1 w_1 w1 units of x1 x_1 x1 and w2 w_2 w2 units of x2 x_2 x2).

Budget Line:

The budget line passing through the endowment point represents the constraint defined by the value of the endowment at market prices. Mathematically, if the price of x1 x_1 x1 is p1 p_1 p1 and the price of x2 x_2 x2 is p2 p_2 p2, the value of the endowment is p1w1+p2w2 p_1 w_1 + p_2 w_2 p1w1+p2w2.

The budget line equation is: p1x1+p2x2=p1w1+p2w2p_1 x_1 + p_2 x_2 = p_1 w_1 + p_2 w_2p1x1+p2x2=p1w1+p2w2

The slope of this line is −p1p2 -\frac{p_1}{p_2} −p2p1, reflecting the rate at which x1 x_1 x1 can be traded for x2 x_2 x2 in the market. The line pivots around the endowment point as prices change.

Optimal Choice:

The point x∗=(x1∗,x2∗) x^* = (x_1^*, x_2^*) x∗=(x1∗,x2∗) is the optimal choice, where the consumer maximizes utility subject to the endowment budget constraint. This point lies on an indifference curve (not shown but implied) that is tangent to the budget line.

The movement from w w w to x∗ x^* x∗ (indicated by the line connecting the two points) suggests the consumer has traded part of their endowment to reach a preferred bundle.

Interpretation:

If x∗ x^* x∗ lies above and to the right of w w w, the consumer has increased consumption of both goods, possibly by selling some x1 x_1 x1 to buy more x2 x_2 x2 (or vice versa), depending on relative prices.

If x∗ x^* x∗ lies below or to the left of w w w, the consumer has reduced consumption, possibly saving or selling goods.

Example of the Endowment Budget Constraint

Let’s walk through an example based on the graph:

Endowment: Suppose the consumer’s endowment is w=(10,5) w = (10, 5) w=(10,5), meaning 10 units of x1 x_1 x1 and 5 units of x2 x_2 x2.

Prices: Let p1=2 p_1 = 2 p1=2 and p2=4 p_2 = 4 p2=4, so the value of the endowment is 2⋅10+4⋅5=20+20=40 2 \cdot 10 + 4 \cdot 5 = 20 + 20 = 40 2⋅10+4⋅5=20+20=40.

Budget Line: The constraint is: 2x1+4x2=402x_1 + 4x_2 = 402x1+4x2=40

Solving for the intercept, if x1=0 x_1 = 0 x1=0, then 4x2=40 4x_2 = 40 4x2=40, so x2=10 x_2 = 10 x2=10. If x2=0 x_2 = 0 x2=0, then 2x1=40 2x_1 = 40 2x1=40, so x1=20 x_1 = 20 x1=20. The budget line runs from (20,0) (20, 0) (20,0) to (0,10) (0, 10) (0,10), passing through (10,5) (10, 5) (10,5).

Optimal Choice: Suppose the consumer trades to reach x∗=(12,7) x^* = (12, 7) x∗=(12,7). Check affordability: 2⋅12+4⋅7=24+28=52 2 \cdot 12 + 4 \cdot 7 = 24 + 28 = 52 2⋅12+4⋅7=24+28=52, which exceeds 40. This suggests a mistake—let’s adjust x∗ x^* x∗ to (8,6) (8, 6) (8,6): 2⋅8+4⋅6=16+24=40 2 \cdot 8 + 4 \cdot 6 = 16 + 24 = 40 2⋅8+4⋅6=16+24=40, which fits the constraint. The consumer sold 2 units of x1 x_1 x1 (value 2⋅2=4 2 \cdot 2 = 4 2⋅2=4) and bought 1 unit of x2 x_2 x2 (cost 4⋅1=4 4 \cdot 1 = 4 4⋅1=4), achieving a preferred bundle.

Graphical View:

The endowment w=(10,5) w = (10, 5) w=(10,5) is plotted, with the budget line sloping downward through this point. The optimal choice x∗=(8,6) x^* = (8, 6) x∗=(8,6) lies on the budget line, and the line from w w w to x∗ x^* x∗ shows the trade path.

Endowment Budget Constraint and Consumer Theory

The endowment budget constraint is central to understanding consumer behavior in markets with initial allocations, such as in general equilibrium theory or the Edgeworth box model:

Flexibility:

Unlike a fixed-income budget constraint, the endowment constraint allows the consumer to leverage their initial holdings. If prices favor their endowment (e.g., p1 p_1 p1 is high relative to w1 w_1 w1), they can trade profitably.

Income and Substitution Effects:

Changes in prices shift the budget line, affecting the consumer’s optimal choice. The endowment effect (a behavioral bias where people value goods they own more) may influence whether they trade away from w w w.

Market Implications:

In a competitive market, the aggregate of all consumers’ endowment budget constraints determines equilibrium prices where supply (endowments) equals demand (optimal choices).

Summary Table: Endowment Budget Constraint Rules

Situation | Feasible? | Explanation |

Consume only endowment w w w | Yes | The consumer can stay at w w w without trading, satisfying the constraint. |

Trade to x∗ x^* x∗ where p1x1∗+p2x2∗=p1w1+p2w2 p_1 x_1^* + p_2 x_2^* = p_1 w_1 + p_2 w_2 p1x1∗+p2x2∗=p1w1+p2w2 | Yes | Optimal choice on the budget line is feasible by trading endowment. |

Trade to x∗ x^* x∗ where cost exceeds endowment value | No | Violates the constraint; the consumer cannot afford x∗ x^* x∗ without income. |

Prices change, shifting budget line | Yes | New prices redefine the feasible set, allowing a new optimal choice. |

Why Does the Endowment Budget Constraint Matter?

Real-World Relevance: It models scenarios like stock trading (selling owned shares), labor markets (trading time for income), or barter economies.

Policy Analysis: Taxes or subsidies on traded goods shift the budget line, affecting optimal choices.

Behavioral Insights: The endowment effect (valuing owned goods more) can lead to deviations from the predicted optimal x∗ x^* x∗.

Potential Considerations

The graph assumes perfect markets and rational behavior. Real-world factors like transaction costs, imperfect information, or indivisibilities in goods might limit trades from w w w to x∗ x^* x∗. The absence of indifference curves in the graph suggests it focuses on the constraint rather than utility maximization, but the optimal choice implies an underlying preference.

Conclusion

The endowment budget constraint extends the standard budget model by incorporating the consumer’s initial allocation, allowing trades to reach an optimal bundle x∗ x^* x∗. The graph visually demonstrates this by plotting the endowment w w w and the budget line, with the optimal choice x∗ x^* x∗ reflecting the consumer’s preference after trading. This framework is essential for understanding market equilibria and individual decision-making, though it assumes rational and cost-free trading.

If you’d like a chart to visualize the endowment budget constraint (e.g., with specific w w w and x∗ x^* x∗ points), please confirm, and I can generate one. Alternatively, I can delve deeper into any aspect or analyze further details if provided! Endowment Budget Constraint – 20 Theory MCQs

1.

What does the endowment budget constraint represent in consumer theory?

A) A fixed income-based budget constraint

B) A constraint defined by the value of initial goods the consumer owns and trades

C) A government-imposed price ceiling

D) The consumer's maximum willingness to pay

Answer: B

Explanation: The endowment budget constraint is based on the initial allocation (endowment) of goods a consumer owns, which they can trade in the market within the value limits of that endowment.

2.

The endowment point

w

=

(

w

1

,

w

2

)

w=(w

1

,w

2

) signifies:

A) The consumer's desired consumption bundle

B) The initial allocation of goods owned by the consumer before trading

C) The maximum utility achievable

D) The income level of the consumer

Answer: B

Explanation: The endowment point shows the quantities of goods initially held by the consumer.

3.

In the endowment budget constraint, the budget line:

A) Passes through the origin

B) Passes through the endowment point

C) Is always horizontal

D) Has no slope

Answer: B

Explanation: The budget line pivots around the endowment point because the total value of the endowment limits feasible trades.

4.

How is the slope of the endowment budget line calculated?

A) As the ratio of income to prices

B) As the negative ratio of prices of the two goods,

−

p

1

/

p

2

−p

1

/p

2

C) As the difference between endowment and consumption

D) It has no slope

Answer: B

Explanation: The slope represents the relative price ratio of the two goods in the market.

5.

Which of the following statements is true about the optimal choice

x

∗

x

∗

in the context of the endowment budget constraint?

A) It lies off the budget line

B) It lies on or below the budget line

C) It maximizes utility subject to the budget constraint defined by the endowment value

D) It is always equal to the initial endowment

Answer: C

Explanation: The consumer maximizes utility subject to trading possibilities limited by the value of their endowment.

6.

If prices change, how does the endowment budget line change?

A) It shifts parallel outward

B) It pivots around the endowment point

C) It disappears

D) It becomes vertical

Answer: B

Explanation: Price changes alter the slope, pivoting the budget line through the fixed endowment point.

7.

If the consumer’s optimal bundle

x

∗

x

∗

lies to the right and above the endowment point

w

w, what does it indicate?

A) The consumer is trading to consume more of both goods

B) The consumer has abandoned the market

C) The consumer has only sold goods

D) An impossibility under the endowment constraint

Answer: A

Explanation: This indicates the consumer sells some units of one good to buy more of both goods, improving overall consumption.

8.

What does the equation

p

1

x

1

+

p

2

x

2

=

p

1

w

1

+

p

2

w

2

p

1

x

1

+p

2

x

2

=p

1

w

1

+p

2

w

2

represent?

A) The consumer’s income level

B) The endowment budget constraint

C) The producer’s supply function

D) Market equilibrium

Answer: B

Explanation: This equation balances the value of consumption with the value of the initial endowment, set by market prices.

9.

Which of the following is NOT true about the endowment budget constraint?

A) It allows consumers to consume their initial allocation without trading

B) It defines the set of affordable bundles after trading

C) It assumes the consumer cannot consume more than their income

D) It depends on market prices of goods

Answer: C

Explanation: Unlike fixed income, the consumer's “income” is determined by the value of their endowment, not a fixed cash income limit.

10.

The endowment budget constraint is particularly important in:

A) Perfectly competitive markets only

B) General equilibrium theory and barter economies

C) Monopoly pricing models

D) Short-term production decisions

Answer: B

Explanation: It models situations where trading initial allocations shapes consumption, as in barter or general equilibrium.

11.

When the consumer trades according to the endowment budget constraint, trading means:

A) Selling some units of a good to purchase others

B) Increasing total goods beyond endowment without cost

C) Ignoring prices

D) Always decreasing consumption

Answer: A

Explanation: Trading reallocates parts of the initial endowment to get different consumption bundles.

12.

How do taxes or subsidies affect the endowment budget constraint?

A) They eliminate the endowment point

B) They shift or rotate the budget line, changing feasible trades

C) They fix the prices permanently

D) They do not affect the budget line

Answer: B

Explanation: Taxes/subsidies change effective prices, shifting the budget line and altering consumption possibilities.

13.

Which behavioral effect can lead consumers to deviate from predicted trading under the endowment budget constraint?

A) Substitution effect

B) Income effect

C) Endowment effect (valuing what is owned more highly)

D) Price elasticity

Answer: C

Explanation: Consumers often overvalue their owned goods, reducing willingness to trade.

14.

In the framework of the endowment budget constraint, the consumer’s feasible set is:

A) All bundles costing less than fixed income

B) All bundles with value equal to or less than the endowment’s value at prevailing prices

C) Any bundle priced above the endowment value

D) Any bundle regardless of prices

Answer: B

Explanation: Consumer can only afford bundles whose price is within the value of what they started with.

15.

Why does the budget line pivot rather than shift entirely in the endowment budget constraint model?

A) Endowment point remains fixed as the consumer’s initial allocation

B) Prices never change

C) Endowment is ignored

D) Consumer income is fixed independent of prices

Answer: A

Explanation: Prices change slope, but the line must go through the fixed endowment point.

16.

If the consumer’s endowment consists mostly of good

x

1

x

1

, and its price drops, what typically happens to the budget line?

A) It becomes steeper

B) It pivots outward, increasing purchasing power related to

x

1

x

1

C) It shifts vertically only

D) It remains unchanged

Answer: B

Explanation: The consumer’s asset value changes with price, altering feasible trades.

17.

Which statement best summarizes an endowment budget constraint?

A) Consumer income is fixed and unrelated to goods initially held

B) Consumer trades from an initial allocation with market prices determining affordability

C) Consumer utility is always maximized without constraints

D) Endowment is irrelevant to consumption choices

Answer: B

Explanation: The endowment budget constraint captures the idea that one trades from what one owns given current prices.

18.

Suppose the consumer chooses the bundle

x

∗

x

∗

that lies exactly at the endowment point

w

w. What does this mean?

A) The consumer made no trades and consumes the initial allocation

B) The consumer’s income has increased

C) The consumer trades all goods

D) The consumer violates the endowment constraint

Answer: A

Explanation: Choosing

w

w means consuming only the initial endowment with no market trades.

19.

In the endowment budget constraint, if the price of one good increases, the budget line:

A) Becomes flatter

B) Pivots inward around the endowment point

C) Shifts parallel outward

D) Has no change

Answer: B

Explanation: Price increase steepens the slope, pivoting the budget line inward around the fixed endowment.

20.

Why is understanding the endowment budget constraint important for economic policy?

A) It predicts government revenue

B) It shows how taxes, subsidies, and market changes affect consumer choices based on what they own

C) It only applies to monopolies

D) It negates market prices

Answer: B

Explanation: Policy influences prices, thus impacting the value of endowments and consumer trade decisions. #EndowmentBudgetConstraint

_edited.jpg)

Comments