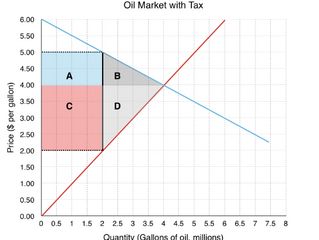

Taxes and Subsidies: Incidence, Deadweight Loss, and Market Impacts

Explore how taxes and subsidies affect markets by shifting supply and demand, influencing prices and quantities, and causing economic incidence and deadweight loss. Learn key concepts and visualize impacts with real-world examples.

_edited.jpg)